The Minimum Credit Score for a Car Loan in Australia: Everything You Need to Know

We know that navigating the world of finance can be a bit daunting, especially when it comes to something as important as purchasing your dream car. But fear not! Whether you’re blessed with an excellent credit score or working towards improving a less-than-perfect one, we’ve got you covered.

In this complete guide, we’ll delve into the nitty gritty of credit scores and their impact on car loans. We’ll explore everything from the role of credit scores in securing a car loan to the specific credit score requirements in Australia.

Plus, we’re here to offer a helping hand to our mates with bad credit, running you through the options available to you. We’ll also share some insider tips on how you can enhance your chances of getting that much-desired car loan approval.

At Tru-Blue Motors, we believe in making the journey to owning your ideal car smooth and enjoyable. So, buckle up and let’s get started on this road trip through the landscape of car loans and credit scores!

Understanding Credit Scores and Car Loans

When diving into the world of car loans, your credit score plays a pivotal role. It’s like a financial passport, giving lenders a quick snapshot of your creditworthiness. In Australia, credit score ranges vary, and understanding where you stand can be crucial in navigating car finance options.

This score is influenced by several factors, including your history of repayments, the amount of credit you’ve used, and your overall financial behaviour.

In the upcoming sections, we’ll unpack the significance of credit scores in the context of car loans, take a look at the typical credit score ranges in Australia, and explore the key factors that can impact your credit score when you’re considering car finance. Whether you’re a seasoned borrower or new to the game, grasping these concepts can be a game changer in your car buying journey.

The Role Of Credit Scores In Car Loans

Car loan eligibility and the terms you receive, including interest rates, are deeply influenced by your credit score. This score, calculated by top credit bureaus like Equifax, Experian, and Illion. These credit reporting agencies’ summary acts as a key indicator of your financial stability and reliability, especially in the eyes of lenders.

A high credit score often unlocks doors to more favourable rates and terms for your car loan. It signals to lenders that you’re a low-risk borrower, which can lead to lower interest rates and better loan conditions.

On the flip side, a lower credit score can present some challenges. It may result in higher interest rates, reflecting the increased risk lenders take on. This doesn’t mean the end of the road for your car loan aspirations, but it does highlight the importance of your credit score in securing advantageous loan terms.

In essence, your credit score plays a pivotal role in not just whether you can secure a car loan, but also in how beneficial those loan terms can be. Understanding your credit score and how it impacts car loans can be a crucial step in navigating the process of financing your next vehicle.

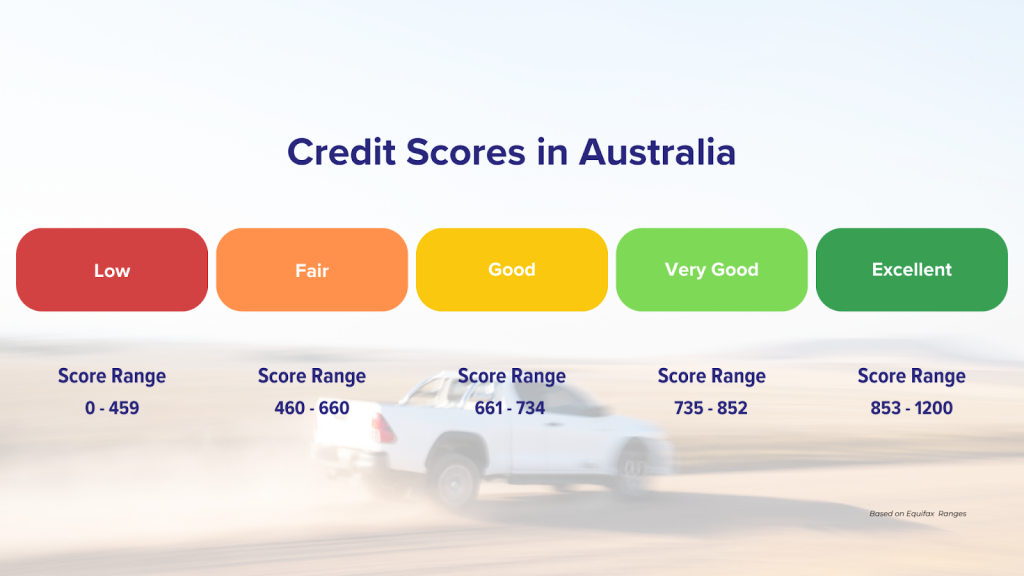

Credit Score Ranges In Australia

The three main credit bureaus in Australia – Equifax, Experian and Illion – generate credit scores by collecting various data points about consumers, to surmise a credit file and report on your overall credit rating.

Actual credit score ranges in Australia might differ depending on the credit bureau reporting on them, but in general, a higher score indicates lower risk for lenders and better chances of car loan approval. A credit score of 700 and above is considered to be a very good credit score, which increases the likelihood of car loan approval and more affordable interest rates.

On the other side of the coin, credit scores below 509 or 550 are considered below average, making it harder for borrowers to obtain car loans and often forcing them to resort to alternative financing options, which may come with higher interest rates and fees

Factors That Impact Your Credit Score For Car Finance

Navigating your credit score is key when you’re in the market for car finance. A few hiccups in your financial history can nudge your credit score south, influencing your chances of snagging those top-notch car loan rates.

The main culprit? Late payments. Whether it’s on credit cards or other loans, missing due dates is a red flag for credit agencies. It paints a picture of risk, potentially leading to a less-than-stellar credit rating and bumping up those interest rates on your car loan.

Your total debt plays its part too. If you’re maxing out your credit or juggling hefty loan amounts, credit bureaus might think you’re biting off more than you can chew. This can darken the view of your credit file, making lenders cautious.

Frequent applications for new credit, like personal loans or credit cards, can also dial down your credit score. It sends a signal of potential financial instability, especially if there are too many inquiries over a short period.

And don’t forget, the length of your credit history and how consistently you pay your bills also weigh in. A track record of irregular payments or a short credit history can ramp up those interest rates.

The takeaway? Keep an eye on these factors. Managing them wisely can steer you towards a smoother path in securing that dream car loan.

Minimum Credit Score Requirements for Car Loans

In assessing car finance applications, lenders might require a specific credit score. This is generally set as a minimum credit score.

An acceptable credit score increases the likelihood of approval and offers much more reasonable interest rates. However, individuals with low credit scores might be subject to higher interest rates on car loans, as lenders perceive them as high-risk borrowers.

Borrowers with below average credit scores may encounter some difficulty obtaining approval for a car loan, and while some lenders may still approve the loan, it is likely to come with a higher interest rate.

Factors Affecting Minimum Credit Score Requirements

Factors such as the lender’s risk tolerance, the type of car loan (secured loan or unsecured loan), and the borrower’s financial history can influence the minimum credit score requirement for car loans.

If a lender is more tolerant of risk, they may be willing to accept lower credit scores for loan approval, whereas a lender with a lower risk tolerance may require a higher minimum credit score.

Another crucial determinant of the minimum credit score required for car loans is your overall income stability. Lenders view a steady and consistent income as a sign of a borrower’s ability to make monthly repayments.

Typical Credit Score Needed For A Car Loan In Australia

In the realm of car loans, understanding the landscape of credit scores can be your key to unlocking the best deals. So, what’s the score you should aim for?

As an example, if your Equifax credit score is hovering around 700 or above, you’re in a pretty sweet spot to get approved for a car loan with a great interest rate.

However, it’s important to note that car loan options aren’t out of reach if your credit score is below average, typically under 509 or 550.

While a lower credit score may limit some lender options, it doesn’t close the door on car finance entirely. This is where car financing options like secured loans and unsecured loans can assist someone with a low credit score. Fortunately, the team at AnyFin Car Loans has access to a vast array of lenders, some of whom don’t base their assessment on your credit score. Meaning, even with a low credit score, you can still get access to low interest rates.

Car Loan Options for Bad Credit Borrowers

Despite a bad credit score, applying for a car loan remains feasible, especially when there are a variety of car loans that require the borrower to provide collateral, as a guarantee for the loan, reducing the risk for the lender and typically resulting in lower interest rates for bad credit borrowers.

If collateral isn’t your thing, unsecured car loans might be the better option, however this car loan application comes with its own risks for the lender and can potentially lead to higher interest rates and fees for borrowers with bad credit.

Thankfully, there are specialised bad credit lenders that cater to customers with lower credit scores, allowing them to still be eligible for car loans.

Secured vs Unsecured Car Loans: Choosing the Right Fit for You

When it comes to car loans, you’ll find two main types: secured and unsecured. Each has its own set of perks, tailored to different financial situations.

Secured Car Loans are like a safety net for both the lender and borrower. By using the vehicle as collateral, they often come with lower interest rates. This is especially handy if your credit score isn’t in tip-top shape. Plus, making timely payments on a secured car loan can polish your credit score over time, setting you up for a brighter financial future.

Unsecured Car Loans don’t ask for collateral, making them a go-to for those who might not want to tie their car to the loan. However, this does mean they often carry higher interest rates, as lenders take on more risk. They’re a solid choice if you have a stronger credit score and are seeking a bit more flexibility.

At the end of the day, the choice between secured and unsecured car loans boils down to your personal financial circumstances and what you feel most comfortable with.

Specialised Bad Credit Car Loan Providers

If you’re facing challenges with your credit score, bad credit car loan options are designed with your needs in mind. At Tru-Blue Motors, we understand that everyone’s financial situation is unique.

That’s why, in partnership with AnyFin Car Loans, we offer tailored car loan solutions, catering even to those with less-than-perfect credit histories. Opting for a bad credit car loan through AnyFin is not just about driving away in your new vehicle; it’s a valuable step towards enhancing your financial well being. Together, we assess a range of factors that extend beyond your credit score, such as your current financial stability and the value of the car you’re eyeing, to help you apply for the best car loan you can get.

AnyFin Car Loans, focuses on your overall potential to manage a loan successfully. These car loans represent a chance to showcase your commitment to responsible financial management. Each timely payment you make is not just a step closer to car ownership but also a stride towards rebuilding and improving your credit score.

At Tru-Blue Motors, we’re committed to supporting you through this journey. We believe in second chances and are here to help you find a car loan that aligns with your circumstances, helping you move forward on the road to financial recovery.

Tips for Improving Your Chances of Car Loan Approval

If you’re looking to improve your bad credit rating before applying for a loan, in order to avoid the sting of a high interest rate, we’ve outlined some of the top recommendations from our team. We’ve tailored these suggestions to help more people access car loans, despite their low credit score.

Boosting Your Credit Score

Prompt bill payments, debt reduction, and regular credit report checks for errors can assist in boosting your credit score. By creating a budget, paying off high-interest debt first, and consolidating debt, you can effectively reduce your overall debt.

It’s recommended to review your credit report at least annually, although some experts suggest checking credit reports more frequently, such as every three to six months, to remain vigilant for any errors or suspicious activity.

Demonstrating Financial Stability

When applying for a car loan, it is essential to demonstrate financial stability. Lenders look at factors such as proof of a steady income, a consistent employment history, and the capacity to make loan payments. A reliable and consistent income indicates financial stability and enhances your likelihood of obtaining approval for a car loan.

Other indicators of financial stability include a positive credit history and score, consistent employment history or the ability to make credit card repayments diligently.

Considering A Co-Signer Or Guarantor

Having a co-signer or guarantor with a good credit score can increase the likelihood of car loan approval and offer more favourable loan conditions. A co-signer is an individual who agrees to share the responsibility of repaying the loan with the primary borrower, providing assurance to the lender that the loan will be repaid. If the primary borrower is unable to make the loan payments, the co-signer becomes legally responsible for paying off the loan.

However, it’s essential to understand that should the borrower fail to comply with the car loan, it can have a detrimental impact on the credit score of both the co-signer and the guarantor.

Apply For Your Dream Car With Confidence

And there you have it – a complete guide to understanding how your credit score plays a pivotal role in your journey towards owning your dream car. Whether you’re sporting a high score or working to boost a lower one, remember, the road to car ownership is always open.

At Tru-Blue Motors, we’re all about making this journey as smooth and supportive as possible. Partnering with AnyFin Car Loans, we’re here to offer you car financing that fits your unique situation. From helping you understand the nuances of car loan rates to guiding you through the options available for different credit scores, we’ve got your back every step of the way.

Ready to take the next step? Regardless of your credit score you can check out our latest vehicles or apply for financing in just a few clicks. With our team by your side, the path to car ownership is more achievable than ever.

So why wait? Let’s get those wheels rolling! Apply for a loan or browse our collection today.